Price Index: measures inflation by tracking changes in the price of a market basket of goods compared to the base year.

Price of market basket of goods in current year - Price of market basket of goods in base year X 100

GDP deflator = price index that is used to adjust from nominal to real GDP.

In the base year, the GDP deflator will equal 100.

For years after the base year, the GDP deflator will be greater than 100.

For years before the base year, GDP deflator is less than 100.

Inflation: new GDP deflator - old GDP deflator / old GDP deflator X 100.

Saturday, January 31, 2015

Budget (GNP/GDP):

GNP- Gross National Product- total value of all final goods and services produced by Americans.

Expenditure approach: C+Ig+G+Xn= GDP

Add up the market values of all Domestic Expenditures made in final goods and services in a single year.

Income approach: adding up all the income earned by households and firms in a single year.

W+R+I+P+statistical adjustments=GDP

Wages Rents Interest Profit

Budget: Government purchases plus government minus government tax and fee collection

If your budget is positive, it is a budget deficit. If your budget is negative, it is a budget surplus.

Exports-Imports

GNP: GDP+ Net Foreign Factor Payments

NNP: GNP- Depreciation

NDP: GDP- Depreciation

National Income: GDP-Indirect Business taxes- depreciation- net foreign factor payment

Compensation of employees+pre income+renters income + interest income + corporate profits.

Disposable personal income: National Income- personal household taxes+government transfer payments

Nominal GDP: value of output produced in current prices.

PXQ

*Can increase from year to year if either output or price increases.

Real GDP: value of output produced in constant or base year prices.

*adjusted for inflation

* can increase from year to year only if output increases.

PXQ

Current production X base price

Gross Domestic Product

Unit II: Part II:

Gross Domestic Product:

GDP- Gross Domestic Product: total dollar value of all final goods and services produced within a country's borders within a given year.

Formulas: GDP:

C+Ig+G+Xn

C= Consumption (67% to the economy- purchasing finished goods and services)

Ig= Gross Private Domestic Investment

1. Factory equipment

2. New factory equipment

3. New constructing housing

4. Unsewed inventory built in a year

G= Government spending

Xn= Net exports

Exports-Imports

Excluded from GDP:

1. Used on secondhand goods

2. Intermediate goods- goods and services that are purchased for resale or for further processing or manufacturing.

*Trying to avoid multiple or double counting

3. Non market activity- illegal drugs, any unpaid work, doing your own repair jobs at home, babysitting, prostitution, growing your own vegetables for your own consumption.

4. Financial Transaction: stocks bonds real estate.

5. Gifts or Transfer Payments:

Gifts are gifts given to you

Transfer Payments:

Private: produces no output, simply transfers funds from one private individual to another. (Ex. Scholarship)

Public: where recipients contribute nothing to the current output or production. (Welfare. Social Security)

Gross Domestic Product:

GDP- Gross Domestic Product: total dollar value of all final goods and services produced within a country's borders within a given year.

Formulas: GDP:

C+Ig+G+Xn

C= Consumption (67% to the economy- purchasing finished goods and services)

Ig= Gross Private Domestic Investment

1. Factory equipment

2. New factory equipment

3. New constructing housing

4. Unsewed inventory built in a year

G= Government spending

Xn= Net exports

Exports-Imports

Excluded from GDP:

1. Used on secondhand goods

2. Intermediate goods- goods and services that are purchased for resale or for further processing or manufacturing.

*Trying to avoid multiple or double counting

3. Non market activity- illegal drugs, any unpaid work, doing your own repair jobs at home, babysitting, prostitution, growing your own vegetables for your own consumption.

4. Financial Transaction: stocks bonds real estate.

5. Gifts or Transfer Payments:

Gifts are gifts given to you

Transfer Payments:

Private: produces no output, simply transfers funds from one private individual to another. (Ex. Scholarship)

Public: where recipients contribute nothing to the current output or production. (Welfare. Social Security)

Wednesday, January 21, 2015

AP Economics: Unit I:

AP Macroeconomics:

Unit I :

A. Basic Economic Concepts:

Macroeconomics: the study of the entire economy which covers the ups and downs of the economy.Ex. GDP Inflation, unemployment

Microeconomics: the study of the economy in which people make decisions and how those decisions interact.

Ex. Supply and demand , market

Positive economics vs. normative economics:

positive economy: describes the economy actually works (fact) ex. minimum-wage laws causes unemployment

normative economy: describes the way the economy should work (opinion)

Ex. price of gasoline is too high

Scarcity vs. shortage :

It is the most fundamental economic problem that all societies face. Trying to satisfy unlimited wants with limited resources.

Scarcity is permanent.

Shortage is where quantity demanded is greater than quantity supplied. This is where its temporary shortage.

Goods vs. Services:

Goods are tangible commodities.

Consumer goods vs. capital goods.

Consumer goods - goods that are intended for final use by the consumer. Ex. Candy bars

Capital goods- are items used in the creation of other goods. Ex. Factory machinery, trucks, tools.

Services: work that is performed for someone else.

Factors of production:

1. Land

-natural resources

2. Labor

-work force

3. Capital

- Human capital- any knowledge and skills gained through education and experience.

-Physical capital- human made objects used to create other goods and services.

4. Entrepreneurship

- Innovative

- Risk takers

Trade offs- Alternatives that we give up when we choose one course of action over another.

Opportunity Cost- is a form of a trade off. It is the most desirable alternative give up by making a decision.

"Guns or Butter"- another form of trade off. Where and how are we using our money

B. Production possibility curve:

Production possibility graph: shows alternative ways to use resources.Production possibility curve/ production possibility frontier- is when a point on the graph is on the curve.

Inside the curve: Not employing all of our resources / Attainable but inefficient. (under-utilization) Ex. Recession, war/famine, underemployment, decrease in population.

Outside the curve: unattainable. Economic growth, technology, discover new resources.

01/14/15

Demand Scenarios:

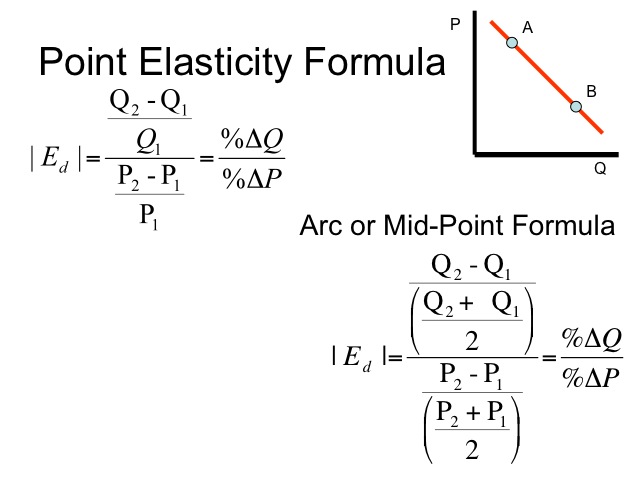

Price elasticity of demand: tells how drastically buyers will cut back or increase their demand for heir goods when a price rises or falls.

1. Elastic demand: demand will change greatly if there is a change in price.Ex. Your wants (steak vs chicken)

e>1

2. Inelastic demand: demand for a product will not change regardless of price. Few or no substitutes

Ex. Think of your needs (water, gas (#1), milk, salt, medicine)

e<1

3. Unit elastic/Unitary elastic: u=1

Elasticity Practice Problems:

1. % 🔼 in quantity

New quantity - old quantity

Old quantity

2. % 🔼 in price

New price - old price

Old price

3. Price Elasticity of Demand: (PED)

PED= 🔼 in quantity

🔼 in price

01/16/15

Equilibrium: Point at which the supply curve and the demand curve intersect. All resources are being inefficiently.

QD= Quantity demanded

QD= Quantity supply

Shortage: QD>QS

Surplus: QS>QD

Price Hour: Government imposed price limit on how low a price can be charged for a product.

Price Ceiling: Government imposed limit on how high a price is charged for a product

Fixed Cost: cost that does not change no matter how much is produced. Ex. Rent, mortgage, insurance, and car note.

Variable Cost: cost that fluctuates Ex. gas, electricity bills, cellphone bill.

Marginal Cost: cost of producing one more unit of a good.

New TC-Old TC

Formulas:

The Business Cycle:

Expansionary: (Growth): real output in the economy is increasing and the unemployment rate is declining. Ex. constructionPeak: real GDP is at its highest.

Contractionary: (Recession): real output in an economy is decreasing and the unemployment rate is rising.

Trough: the lowest point of real GDP. (not low enough for a depression)

Subscribe to:

Posts (Atom)